What India’s Exporters Need to Know About Israel–Iran Tensions

Introduction

Amid rising global tension, Israel and Iran continue trading strikes, reigniting regional tensions and putting two of India’s main shipping routes—the Strait of Hormuz and the Red Sea corridor—on edge. It is still too early to say, but if the escalation continues, Indian exporters might feel the ripple effects through higher freight rates and longer detours resulting in shipment delays.

Strategic Importance of the Region

Strait of Hormuz

Nearly two‑thirds of India’s crude oil imports and half of its LNG pass daily through this narrow channel—making it indispensable to India’s energy security.

Red Sea

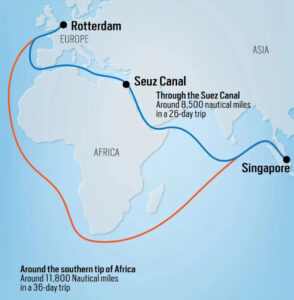

Approximately 30% of India’s west‑bound exports to Europe, North Africa and the US East Coast traverse this route, saving off up to 15–20 days compared with the longer Cape of Good Hope detour.

Current Implications

Shipping Lane Volatility

After Houthi attacks in late 2023 halted Red Sea traffic, vessels gradually returned to the red sea—capitalizing on shorter transit times.

However, Israel’s recent strikes on Iran risk rekindling maritime insecurity in the Red Sea and adjacent waters.

Export Disruption Concerns

Exporters have expressed apprehension that further escalation could prompt carriers to again avoid the Red Sea corridor—reinstating the longer Cape circuit and adding 15–20 days to shipment durations.

Freight Cost

Any rerouting via the Cape not only stretches delivery schedules but also drives up fuel consumption, port dues, and insurance premiums.

Exporters should closely monitor freight‑rate movements so they can negotiate contracts and maintain supply‑chain commitments.

The Israel-Iran conflict is likely to push up shipping costs and air freight costs for Indian exporters and could also lead to supply chain disruptions, though the magnitude of the impact will only unfold over the next few days, according to Ajay Sahai, chief executive officer of the Federation of Indian Export Organizations.

Government and Industry Response

Stakeholder Consultations

The Commerce Ministry has convened meetings with shipping lines, container firms and exporter associations to assess immediate risks and define contingency plans.

Commerce Secretary Sunil Barthwal emphasized that intensifying hostilities would directly affect freight costs and trade flows.

Alternate Routing Strategies

In parallel, industry stakeholders are evaluating enhanced utilization of Indian west‑coast ports (Mundra, Nhava Sheva, Kochi) and exploring feeder connections to Southeast Asian hubs—aiming to buffer any Red Sea disruptions.

Conclusion

The Israel–Iran conflict remains at a nascent stage, and its full impact on India’s export and freight sectors will depend on whether the situation escalates.

It’s better to get ahead of this—talk to your logistics teams now and plan your upcoming shipments accordingly to avoid high freight and insurance bills, as well as shipment delays.